Years ago at TOF's over-the-hill 40th b'day party he was given a "newspaper" full of headlines and such from the year he was born. Included was a list of the price of several things in birth year versus then-current year, including the median wage, an ounce of gold, a new home, a new Ford automobile, a loaf of bread, a jug of wine and some thou.

Being inquisitive, TOF divided everything by the gold price to convert from dollars to ounces and learned that the median wage and the new car were about the same in gold. Houses cost more in gold; and bread, milk, etc. cost less. The latter was probably because some of the cost was hidden as taxes for farm subsidies. IOW, we were paying low prices with the right hand while with the left we were paying extra to finance those low prices.

But in another sense, the price of the house (and the car) had dropped. A car in 1987 was not the same thing as a car in 1947, but a much more complex machine with more qualities [features]. Ditto, for a house built in those years. A new house in 1987 had more stuff than a new house in 1947.

No one pays per unit, but per quality (feature, use). This was brought home by the purchase of cheap "generic" paper towels. They were half the price of the brand-name towels, but had lower absorbency and we wound up using them three times faster. It then occurred to TOF that the real price was not how many pennies per towel, but how many pennies per mop-up. Similarly, the price of a light bulb is not pennies per bulb, but pennies per hour of illumination. And so on. That is, people buy qualities, not products. Black and Decker sells holes, not drills.

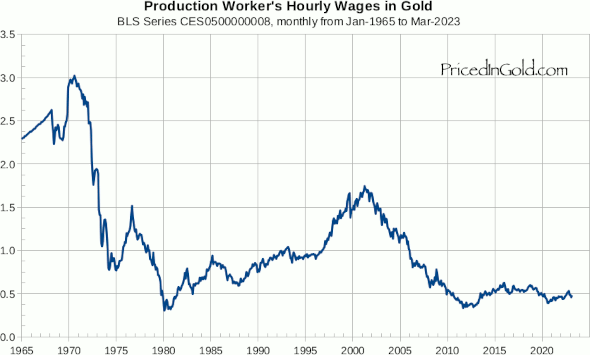

Meanwhile, TOF has recently discovered a web site that gives various prices in terms of grams of gold. For your enjoyment, a few choice examples:

Notice the precipitous drop in real-value wages during the Great Inflation of the 1970s. It was worse than this: Increases in nominal dollar value wages pushed workers into higher tax brackets without providing them with increased purchasing power. Since the tax brackets were not then indexed for inflation, the government took a bigger cut of the workman's wage and take-home pay decreased even more. Then, beginning in the 1980s, wages began to recover value. The tax brackets were indexed to inflation, so that workmen would not have to pay higher % in taxes simply because their $$$ were worth less. We should probably find out who was president at the time and see what policies he pursued. Then in 1995 something happened that accelerated workman's wages, lasting up to ca. 2002 when the dollar collapses. We should find out what happened that year as well.

How much did the dollar collapse?

It loses about half its value every four years:

And since 2001 has conformed nicely to a decaying exponential curve. (But if you look at the far left of the graph you will see that this was not the case prior to 2001. A model fits the data only insofar as the model assumptions remain valid. That's why one should never extrapolate.) If this model continues to hold, the dollar will become essentially valueless by about 2030, when global warming resumes.

Meanwhile, the site does not have gas-at-the-pump, but does have West Texas Intermediate crude oil prices in golden terms:

where we see that the price per barrel in gold has flip-flopped of late between two quantum states and remained more-or-less stationary in each state. The levels are about a gram apart, but have ratcheted up by half a gram. 1975-85 around 2.5, 1985-2000 around 1.5; 2000-2010 around 3.0; since around 2010, around 2.0. The dollar price is climbing because the dollar has a half-life of only four years and is declining in value.

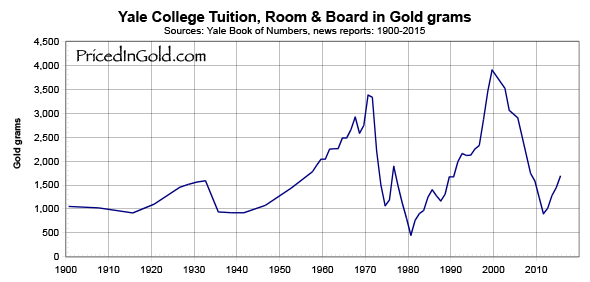

Tuition, room and board at Yale:

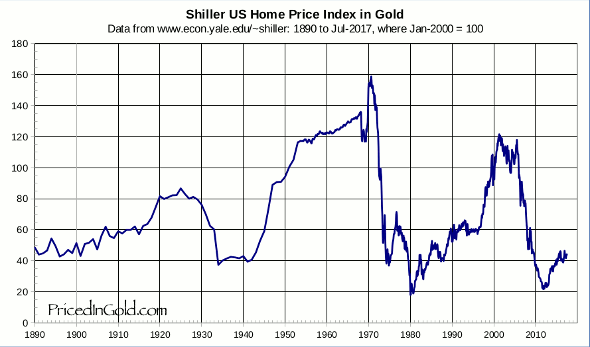

Home price index

and so on. The peaks at 1970 and 2000 in most of the charts are due to the dollar strengthening against gold in the decades before.

In the spirit of "nobody pays for quantities, they pay for qualities," what is the qualitative value of an ounce of gold? Why assume that it remains constant? Would a more averaging measure like the contemporary-dollar-valued cost-of-living be a better indicator?

ReplyDeleteThere are all sorts of things that one could pick as a standard of value; gold's just another one. Of course, that puts the burden on me to come up with charts that show any differences compared to the charts using the price of an ounce of gold. I'll bow out now. :)

Apropos of nothing, there's not enough gold in the world to put the U.S. economy back on the gold standard; the price-value of 100% of the gold ever mined, using a generous estimate of the quantity, is somewhere south of 5/8 the value of the U.S. economy.

You are thinking of gold-convertability, not gold standard. The dollar value of the US economy however is denominated in inflated units. Unlike the inch, the ounce, the ohm, and the hour, the dollar is not tied to any particular metric standard. There is no standard dollar kept at NIST.

DeleteGold is attractive as a standard because

a) pretty much all the gold ever mined still exists

b) new gold being discovered and mined is small compared to the existing store of gold

This means that, barring some new Klondike, the real value of gold in terms of supply and demand is not going to fluctuate very much. If a dollar were standardized at so many troy ounces, the result would be a limit on how many dollars were allowed into circulation. It would not necessitate exchanging dollars for gold dust.

Silver is pretty, but more subject to fluctuations in supply, and especially its value with respect to gold.

Platinum has its attractions as well.

I don't understand how, if the U.S. economy is denominated in inflated dollars, its total value in those dollars is roughly 1.6 times the value (in those same dollars) of all the gold ever mined.

DeleteIn other words, going back on the gold standard would set an arbitrary limit to value, it seems to me: the whole of the worlds production and assets is not permitted be valued at more than the value of 18,000 cubic feet of gold. That sounds like a recipe for deflation.

What am I missing?

Having another try at cliology, are you? :)

ReplyDeleteThis comment has been removed by the author.

ReplyDelete